In today’s heavy device enterprise, crane finance plays an essential role in assisting production businesses develop without onerous capital reserves. Whether you are a contractor seeking to amplify your fleet or a startup needing your first tower crane, information crane financing alternatives can save money and time. With increasing infrastructure investments in 2025, crane possession is becoming extra feasible due to tailor-made financing solutions. From leasing to traditional loans, crane finance allows small to large companies to gather high-cost cranes with flexible terms. This article explores every element of which include how it works, best practices, blessings, and what to remember before committing.

| High-Priority Topic | Effectiveness of “Crane Finance” Keyword |

| Types of Crane Financing Options | Very High |

| Benefits of Crane Leasing | High |

| Credit Score Requirements | Medium |

| Top Crane Finance Providers in 2025 | Very High |

| How to Apply for Crane Finance | High |

| Tax Advantages of Financing Cranes | Medium |

| Crane Loan vs. Lease Comparison | High |

When it involves crane finance, businesses usually have 3 primary alternatives to consider:

With an equipment loan, you own the crane and repay the borrowed amount through the years. Crane finance companies normally require a down payment of 10-20%.

In this model, you rent the crane for a hard and fast duration. This is best for quick-term initiatives or corporations looking to conserve capital.

You use the crane even as making everyday bills and advantage complete ownership on the stop of the time period.

Offers fast approval, no collateral loans, and flexible price alternatives.

Excellent for small companies, particularly the ones new to crane finance.

Caters to large production corporations with aggressive interest costs.

Instead of spending loads of hundreds upfront, corporations can hold liquidity.

Fixed month-to-month bills make budgeting and forecasting less difficult.

Depending on your vicinity, you’ll be eligible for Section 179 deductions or different equipment-related tax breaks.

Most creditors examine your eligibility based on:

- Credit rating (minimal 600–650)

- Time in business

- Revenue stability

- Debt-to-income ratio

Startups can nevertheless qualify for crane finance, especially with a strong business plan or a co-signer.

| Criteria | Buying | Leasing |

| Ownership | Immediate | No |

| Monthly Payment | Higher | Lower |

| Tax Benefits | Depreciation | Full payment deductible |

| Flexibility | Less | High |

| Upfront Cost | High | Low |

Crane finance via leasing is right for quick-time period wishes, while buying suits lengthy-time period investments.

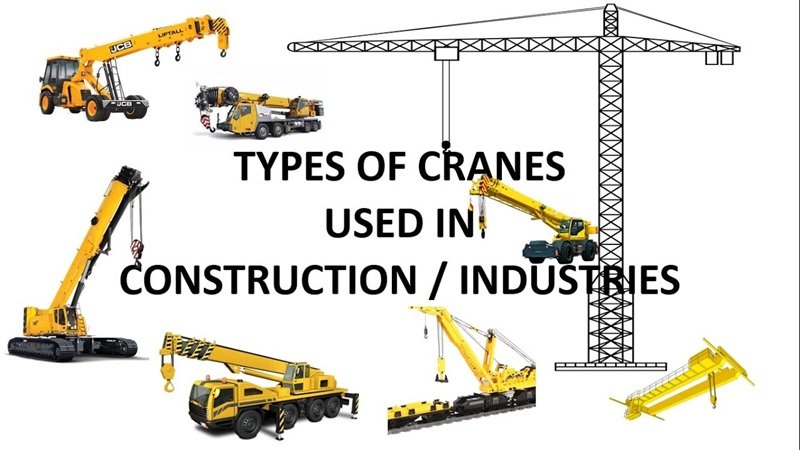

Understand what type of crane you need (tower, cell, hard terrain, and so on.).

Gather documents like tax returns, bank statements, and credit score reports.

Search for lenders that specialize in crane finance.

Submit all required documentation and look ahead to approval.

Once accepted, finances are allotted speedy—every so often within 24-forty eight hours.

- Early termination fees

- Balloon payments

- Maintenance expenses

- Insurance charges

Always examine the high-quality print when considering a crane finance settlement.

- Improve your credit score score earlier than applying

- Negotiate payment terms

- Choose cranes with excessive resale cost

- Bundle insurance for reductions

With virtual structures making equipment financing faster and smarter, anticipate:

- AI-driven loan approvals

- Blockchain-secured finance contracts

- Subscription-primarily based crane utilization fashions

The crane finance panorama is evolving swiftly to fulfill the demands of present day production companies.

Crane finance empowers production companies to collect vital systems without heavy premature charges. With flexible phrases, tax blessings, and evolving technology, it is becoming a preferred choice for contractors international. Understanding all elements—from providers to utility steps—can help groups make informed economic decisions and improve operational performance.

Crane finance refers to loan or hire alternatives used by groups to collect cranes without paying the full price upfront.

Yes, many creditors provide crane financing to startups with strong enterprise plans or co-signers.

All sorts which include tower, cell, crawler, and difficult terrain cranes may be financed.

Leasing offers flexibility and decreases in advance fees, even as shopping is higher for lengthy-term use and asset ownership.

Common documents include tax returns, bank statements, ID proof, and crane specs.

Yes, many countries offer tax deductions for equipment leasing or depreciation blessings for possession.

Approval instances range however can be as short as 24–48 hours with the right documents.

This article is intended for informational functions simplest. Please consult a licensed monetary advisor or system finance expert before making any financial choices. Terms and rules related to crane finance may vary with the aid of the United states, lender, and man or woman situations. Always study the nice print earlier than signing any agreement.

Also Read Cricket Pay Bill Phone Number: The Ultimate Guide to Hassle-Free Payments